A COVID-Related Development for 2020 Individual Tax Returns

At Maicher CPA Pllc, we provide a full range of tax services to help clients reduce taxes. There is an important COVID-related development along with other developments affecting 2020 individual tax returns.

- The IRS has extended the deadline for filing 2020 individual federal income tax returns to May 17, 2021. This extension includes tax payments as well. However, be aware that:

- This extension does not apply to corporations or trusts.

- This extension does not apply to first-quarter 2021 estimate payments for income.

- For those owed refunds, refunds are only issued when you file your return.

- Individuals do not need to file a form for this automatic extension.

- Minnesota has similarly extended the deadline for individual returns and payments, but extension by other states require confirmation.

- Lastly, if you need an extension to file, you will need to file IRS Form 4668 by no later than May 17, 2021 to receive an automatic six-month extension but this filing extension does not extend your payment due date.

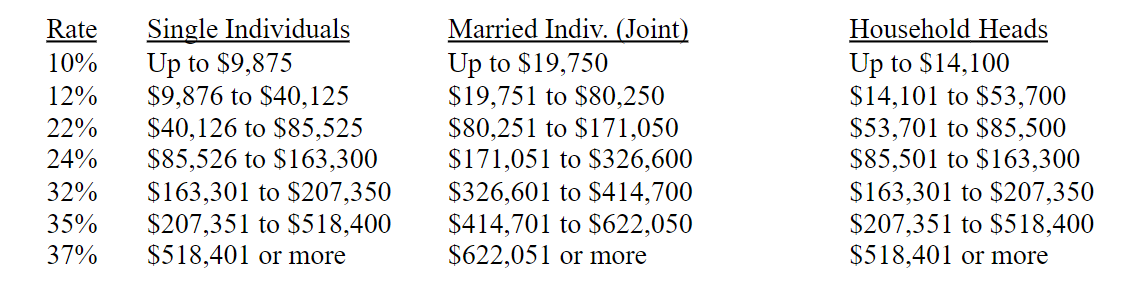

- Income tax brackets increased in 2020 to account for inflation as follows:

- For 2020, the long-term capital gains rates for individuals are as follows: (a) for unmarried individuals with taxable income of over $40,000, the rate is 15% and 20% for taxable income of over $441,450; (b) for married individuals filing joint returns, the rate is 15% for taxable income of over $80,000 and 20% for taxable income over $496,600; and (c) for heads of households, the rate is 15% for taxable income of over $53,600 and 20% for taxable income for over $496,050.

Take-away: Tax rules are in flux but the tax professionals at Maicher stays on top of these changes. Call Maicher today for an appointment for your 2020 tax return.

Sources:

IRS Publication – “Tax Day for individuals extended to May 17: Treasury, IRS extend filing and payment deadline.” (March 18, 2021).

IRS Publication (Topic No. 409) – “Capital Gains and Losses.” (March 12, 2021).

IRS Publication – “IRS Provides Tax Inflation Adjustments for Tax Year 2020.” (December 17, 2020).